Market Conditions, Trends & Home Prices in San Francisco

January 2018 Update Report

Looking Back on 2017, Looking Forward to 2018

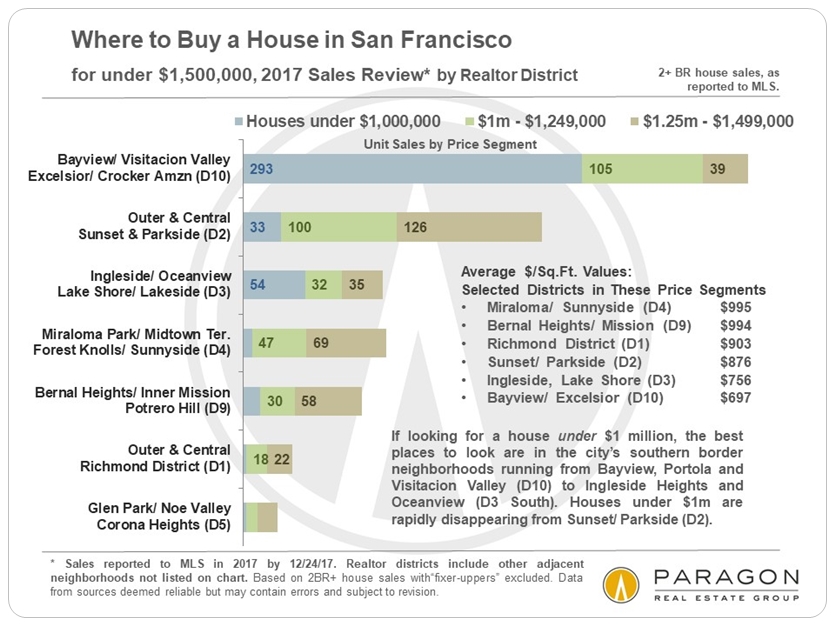

The median SF house sales price in 2017 was $1,420,000 (up from $1,325,000 in 2016), and for condos, it was $1,150,000 (up from $1,095,000). Looking just at the 4th quarter, median prices were $1,500,000 for houses (up from $1,350,000 in Q4 2016) and $1,185,000 for condos (up from $1,078,000).

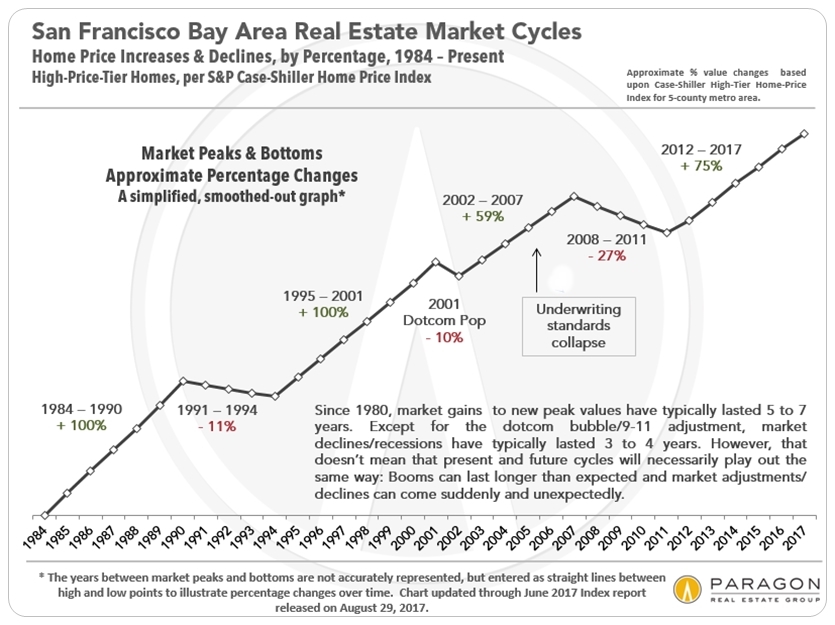

The chart below, based on S&P Case-Shiller Index data, tracks general price appreciation trends of homes in the upper third of prices in the 5-county SF Metro Area. Case-Shiller does not base their calculations on median sales price changes but uses its own proprietary algorithm. This chart has been simplified to only reflect percentage increases and decreases from various points in real estate cycles. Since it covers 5 counties, it is a very generalized illustration.

Moving into 2018, there are a lot of spinning plates in the air - local, state, national and international factors that could affect markets. 2017 saw real estate markets surge and financial markets soar. After some cooling from mid-2015 to mid-2016, the Bay Area high-tech economy surged back into high speed, with companies leasing enormous spaces in newly built office buildings - which they will presumably fill with new hires. Unemployment rates have flirted with historic lows, and 2018 may see some major local IPOs, which could create great quantities of new wealth. The Bay Area still has probably the most dynamic, innovation-fueled economy in the world and indisputably remains among the great metro areas on the planet - but there are also significant social, economic, political and environmental challenges looming.

Congress delivered an unpleasant holiday present to many Bay Area residents in the form of federal tax law changes limiting the deductibility of mortgage interest and state and local taxes. The effect of these changes make living in an already high cost-of-living area more costly for many residents, and also reduce some of the financial incentives of homeownership, especially for more expensive homes. Predictions on the effect of these tax changes on local housing markets and the business environment range from one extreme (economic devastation) to the other (shrug), and the state legislature is currently working on bills that might blunt the negative financial impacts. It is too early to guess how it will all play out. We live in interesting times.

This January 2018 report will range far and wide looking at real estate, and some economic and demographic issues that impact it. Most of the charts are self-explanatory, so we have kept the text to a minimum. A review of annual, year-over-year, real estate market trends in San Francisco are at the end of this report.

SF Home Prices by Neighborhood

The following tables and charts are part of a larger survey, which can be provided upon request.

Annual Market Trends

Most of these annual trend charts show the market heating up again in 2017 after some cooling in 2016. Very generally speaking, since 2015, the house market has been hotter than the condo market, and the more a ordable neighborhoods hotter than the more expensive. But 2017 was a strong year across virtually all market segments.

Please let us know if you have questions or if we can be of assistance in any way. Information on neighborhoods not included in this report is readily available.

If you will forgive a little celebration on our part: In 2017, Paragon became the largest brokerage in San Francisco by dollar volume sales of residential and multi-unit residential real estate (as reported to MLS, per Broker Metrics). We opened our doors in 2004.

It is impossible to know how median and average value statistics apply to any particular home without a specific, tailored, comparative market analysis. In real estate, the devil is always in the details.

These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of di erent markets in San Francisco and the Bay Area, each with its own unique dynamics. Median prices and average dollar per square foot values can be and often are a ected by other factors besides changes in fair market value. Longer term trends are much more meaningful than short-term. Late-reported MLS activity may change certain statistics to some small degree.

© 2018 Paragon Real Estate Group